Open Banking in Fintech: What is it and How Does it Work?

Open Banking allows banks and other

financial organizations to share client financial information with other banks

and approved organizations. The data shared by Open Banking can be used to

develop innovative financial services and products, like comparison tools and

personal finance management apps.

Table of Contents:

1.

What is Open Banking?

2.

What are Open Banking Payments?

3.

How Open Banking Works

4.

Benefits of Open Banking

5. Challenges

and Concerns

6. Open

Banking Payment vs. Traditional Payment Methods

7. Future

of Open Banking

8. Conclusion

9. FAQ

What is Open Banking?

Open Banking is a transformative approach to the financial

services industry. Banks and other financial institutions can share customer

information with third-party providers through Application Programming

Interfaces (APIs). This means consumers now have more control over their

financial data and can use it to access a wider range of services.

What are Open Banking Payments?

Open Banking Payment is a revolutionary approach to

financial transactions that enables customers to make payments directly from

their bank accounts through third-party applications. By leveraging APIs

(Application Programming Interfaces), Open Banking allows secure data

sharing between banks and authorized service providers, enhancing the

convenience and efficiency of payments.

Read also: Online Banking

How Open Banking Works

At its core, Open Banking uses technology to create a

secure environment for sharing financial data. Here’s how it generally works:

APIs: Banks provide secure APIs that allow other financial

service providers to access customer data after obtaining their consent.

1. Customer

Control: Customers can choose with whom they want to share their

data, giving them more control over their banking experience.

2. Third-Party

Providers: These can range from budget management tools to

payment services, which can analyze customer data to offer personalized

services and advice.

Related article: API Banking

Benefits of Open Banking

For Consumers:

1. Personalized

Services: Open Banking allows for customized financial products that

suit your individual needs and preferences.

2. Convenience:

Manage

various accounts and financial products from a single platform without needing

to log into multiple bank websites.

3. Better

Financial Choices: Access to various options including loans,

insurance products, and investment opportunities tailored to your financial

profile.

4. Informed

Decision-Making: With access to detailed financial data and

analytics, you can make better-informed financial decisions.

For Financial Institutions:

1. Innovation:

Open

Banking encourages banks to innovate their services and improve customer

experiences, enhancing their overall offerings.

2. Increased

Competition: By providing a platform for new entrants, banks

must compete on services rather than just pricing, potentially leading to

better options for customers.

3. Collaboration

Opportunities: Traditional banks have the opportunity to

partner with fintech companies to create new products and services, expanding

their market reach.

Challenges and Concerns

Despite its benefits, Open Banking faces various

challenges:

1. Data

Security

There are concerns around the security of personal data

shared with third parties. Banks and third-party providers must implement

stringent measures to protect sensitive information.

2. Regulatory

Compliance

Navigating the complex landscape of regulations governing

data sharing can be daunting for both banks and providers, requiring constant

updates and adherence.

3. Consumer

Awareness

Many consumers are still unfamiliar with Open Banking and

may feel apprehensive about sharing their financial data, highlighting the need

for education and transparency.

Open Banking Payment vs. Traditional Payment Methods

When comparing Open Banking Payments with traditional

payment methods, several key differences emerge:

|

Features |

Open Banking |

Traditional

Payment |

|

Transaction Speed |

Typically faster |

Can be slower due to

intermediary processing |

|

Fees |

Usually lower |

Often involves

higher transaction fees |

|

Data Sharing

|

Users control access

to their data |

Limited user control

over data security |

|

User Authentication |

Stronger,

multi-factor authentication is required |

Basic authentication

often suffices |

Future of Open Banking

The future of Open Banking looks promising as more

consumers and institutions recognize its advantages. Here are some key trends

to watch:

1. Increased

Adoption: As awareness grows, more consumers are likely to embrace

Open Banking, seeking its benefits.

2. Enhanced

Security Protocols: The industry will likely invest in advanced

security measures to address concerns over data privacy and security.

3. Broader

Services: We can expect more diverse products and services that

integrate financial data into daily life, enabling a seamless experience.

Conclusion: Open Banking

Open Banking is reshaping how we view and manage our

finances. By allowing for safe, controlled sharing of financial data, it

empowers consumers with better choices and personalized services. While

challenges remain, the benefits position Open Banking as a vital force in

the evolution of financial services. To stay updated on this transformative

trend, consider exploring the services offered by various providers and how

they can enhance your financial management experience.

If you'd like more insights on Open Banking and its

implications for your finances, don’t hesitate to contact us or share your

experiences below!

FAQs: Open Banking

Q1. What is meant by open banking?

Open banking is a financial services framework that enables

third-party service providers to obtain consumer data from conventional banking

systems via application programming interfaces (APIs).

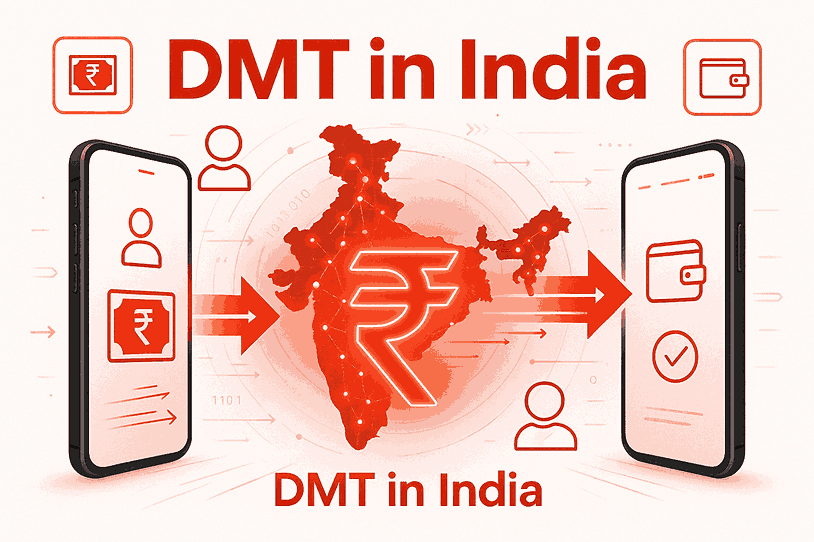

Q2. Is UPI an example of open banking?

UPI is a strong example of open banking in action,

especially in payments, but it’s not full open banking like Europe or the UK,

where it covers broader financial services.

Q3. What are the risks of open banking?

Open banking presents certain risks, particularly as

fraudsters tend to exploit vulnerabilities in third-party providers that may

not possess the same level of fraud prevention measures and awareness as

traditional banks

Q4. Can open banking be trusted?

Yes, all participants in Open Banking must adhere to data

protection laws and obtain Financial Conduct Authority approval.