How Domestic Money Transfer Works in India | DMT Benefits & Scope

Domestic

Money Transfer (DMT) services have revolutionized the way people send money

across India. Whether it's a migrant worker sending money home or a small

business helping customers transfer funds, DMT offers a fast, secure, and

accessible solution — even in areas with limited banking infrastructure.

In this

blog, we’ll break down how the DMT system functions, its key benefits, and how

it creates profitable opportunities for businesses and agents alike.

Table of Contents

1.

What

is a Domestic Money Transfer?

2.

Top

7 Benefits of Domestic Money Transfer Services

3.

How

Does the DMT Process Work?

4.

Who

Can Start a DMT Business?

5. Conclusion

What is Domestic Money Transfer?

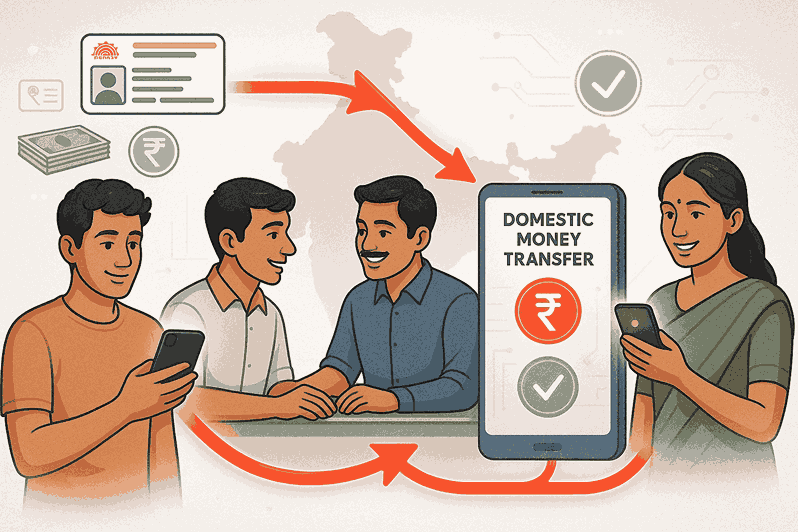

Domestic Money Transfer (DMT) refers to the digital transfer of money within India through banking channels or authorized agents. It allows users to send funds from one part of the country to another instantly, using their mobile numbers or bank accounts — often through Aadhaar or IMPS/NEFT technology.

Top 7 Benefits of Domestic Money Transfer Services

1.

24x7 Availability

Users can transfer money anytime, even on weekends or holidays, through agent

networks or mobile apps.

2.

Instant Transfers

Money is credited instantly to the beneficiary’s bank account, eliminating

delays common in traditional banking.

3.

Pan-India Coverage

DMT agents are available in urban as well as rural areas, making the service

highly accessible.

4.

Minimal Documentation

No complex forms or paperwork. Most transfers need just a mobile number and

identity verification.

5.

Secure Transactions

Transfers are backed by robust banking infrastructure (IMPS/NEFT), ensuring

secure delivery.

6.

Financial Inclusion

Helps the unbanked and underbanked sections participate in the formal economy.

7.

Business Opportunity for Agents

Retailers, kirana store owners, and CSCs can become DMT agents, earn

commissions, and boost footfall.

How Does the DMT Process Work?

1.

Sender visits a DMT agent with cash and beneficiary details.

2.

Agent initiates the transaction using a DMT portal or API.

3.

Money is debited from the agent’s wallet and credited to the recipient's bank account.

4.

Confirmation

is sent via SMS or app notification.

Alternately, fintech platforms integrate DMT APIs into their systems to offer the service digitally.

Who Can Start a DMT Business?

1.

Retailers

& kirana stores

2.

Mobile

recharge and utility payment shops

3.

Entrepreneurs

in rural and semi-urban areas

4.

Startups

looking to offer embedded financial services

All it takes is a partnership with a reliable API provider, basic infrastructure (a smartphone or system with internet), and KYC compliance.

Conclusion

Domestic

Money Transfer is more than just a convenient way to send money — it’s a bridge

to financial empowerment for millions. As demand for instant, secure

transactions grows, so does the opportunity for agents and businesses to enter

this space profitably.

If you’re a

retailer or fintech business looking to offer DMT services, partnering with a

robust and compliant platform can open new revenue streams and strengthen

customer trust.

Frequently Asked Questions (FAQs)

1. What is the meaning of Domestic Money Transfer (DMT)?

Domestic

Money Transfer refers to the electronic transfer of money within a country,

typically using bank accounts or mobile numbers. It enables users to send funds

quickly and securely, even without visiting a traditional bank branch.

2. How long does it take for a domestic money transfer to complete?

Most

domestic transfers using DMT are processed instantly via IMPS or NEFT. In rare

cases, especially outside banking hours, NEFT transfers may take up to a few

hours.

3. Do I need a bank account to send money through DMT?

No, senders

do not necessarily need a bank account. DMT agents can collect cash and send it

to the recipient’s bank account using their digital platforms.

4. Is it safe to transfer money through DMT agents?

Yes, as long

as the agent is registered and operates under a compliant API provider, DMT

transactions are secured using encrypted banking networks like IMPS and NEFT.

5. Who can become a DMT agent?

Retail shop owners, mobile recharge stores, internet cafés, and small business operators can become DMT agents by partnering with a certified API provider. They only need minimal setup and KYC verification.