API Banking: Types and How It Works?

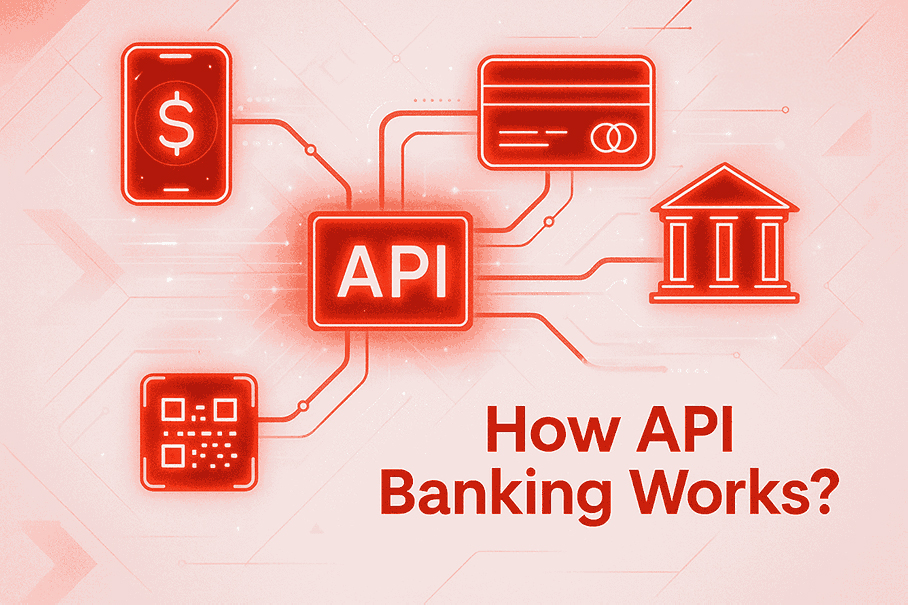

Application Programming Interface (API) Banking: API

Banking uses XML/JSON codes (APIs) to communicate between the bank and client

servers, facilitating data transfer between these two systems and guaranteeing

a secure and smooth integration between the bank and the customer's systems.

This feature enables the customer to conduct banking

transactions easily without switching between the bank and the Enterprise

Resource Planning (ERP) platform.

Table of Contents

1.

What is API Banking?

2.

Types of Banking APIs

3.

How API Banking Works?

4.

Benefits of API Banking

5.

Simplifying Financial Services with APIs

6.

Future Impact and Monetization Potential

7.

Conclusion

API Banking

API Banking enables secure, real-time communication between

a bank’s core system and third-party platforms through APIs (Application

Programming Interfaces), typically built using XML or JSON. This allows

businesses to access banking services—like payments, account data, and

loans—without switching between systems, such as an ERP or mobile app.

Types of Banking APIs

1.

Open Banking APIs

Enable secure sharing of customer data with authorized third-party providers,

offering users access to a broader range of financial services while retaining

control over their data.

2.

Payment APIs

Facilitate seamless financial transactions like money transfers, bill payments,

and purchases within digital platforms.

3.

Data APIs

Provide access to essential financial information such as balances, transaction

histories, and statements, aiding in analytics and decision-making.

4.

Authentication APIs

Ensure user identity verification through secure methods like two-factor

authentication or biometrics, protecting access to financial services.

5.

Lending APIs

Streamline the loan lifecycle—from application to approval and

disbursement—enabling faster and more efficient access to credit.

6.

Core Banking APIs

Connect external systems to a bank’s central infrastructure, enabling functions

like account management, transaction processing, and customer services.

7.

Banking-as-a-Service (BaaS) APIs

Allow

non-banks to offer financial services by leveraging the infrastructure of

licensed banks, such as digital accounts or payment solutions.

8.

Fraud Detection APIs

Use advanced analytics to monitor transactions for suspicious activity,

enhancing security and minimizing financial risk.

9.

Regulatory & Compliance APIs

Help

financial institutions meet legal requirements by automating KYC, AML, and

other compliance processes.

How Does API Banking Work?

1.

Customer Makes a Request

A user initiates a transaction via a fintech app or e-commerce site.

2.

App Sends API Call

The app connects with the bank via a public API

3.

Bank Receives Request

The API forwards transaction details securely to the bank's core system.

4.

Verification and Processing

The bank authenticates the user, checks the balance, and runs fraud checks.

5.

Transaction Completion

The bank executes the transaction and updates records.

6.

Response Sent to App

The customer receives confirmation in real-time.

Benefits of API Banking

1.

Faster Transactions: Enables

real-time processing with minimal friction.

2.

Improved Customer Experience: Users

can manage finances within one interface.

3.

Secure and Compliant: Modern

APIs follow REST/OpenAPI standards with built-in security.

4.

Automation & Efficiency: Reduces

manual work through system integration.

5.

Data Accessibility: Breaks

data silos and unlocks business insights.

6.

Scalability: Easily

integrate or upgrade modules without system-wide changes.

7.

Product Innovation: Banks

can collaborate with fintechs to create new offerings.

How APIs Simplify Financial Services

API banking supports modular

system design, allowing banks to:

1.

Update components without disrupting the entire

system.

2.

Integrate new third-party tools like Plaid or

Yodlee effortlessly.

3.

Deploy updates incrementally and test

efficiently.

4.

Maintain service stability even during

upgrades.

The Future and Monetization Potential of API Banking

API banking is central to the digital transformation of the financial sector. It enables banks to generate new revenue streams by offering APIs as commercial products, while also allowing fintechs to build innovative services on top of existing banking infrastructure. Internally, APIs streamline operations through automation, reduce costs, and support faster innovation. As API adoption grows, banks become more agile, competitive, and better equipped to meet evolving customer expectations.Conclusion: Why API Banking Matters

API Banking is revolutionizing how financial services are

delivered. It empowers banks and fintechs to collaborate, enhance customer

experiences, and innovate at scale. As open banking and embedded finance grow,

API Banking will remain central to building a modern, interconnected financial

ecosystem.