Embedded Finance: How Non-Fintech Businesses Can Unlock New Revenue Streams with SprintOPN APIs

What is Embedded Finance?

Embedded

finance is the

integration of financial services like payments, lending, insurance, and

investment directly into non-financial digital platforms—retail apps, travel

sites, e-commerce portals, and more. Businesses can now offer bank-like

services without building banking infrastructure from scratch, thanks to

powerful APIs like those from SprintOPN.

Table of Contents

1.

Why

Embedded Finance Matters for Non-Fintech Businesses

2.

How

SprintOPN APIs Power Embedded Finance

3.

Real-World

Examples & Use Cases

4.

Creating

New Revenue Streams

5.

Best

Practices for Successful Integration

6.

Conclusion

Why Embedded Finance Matters for Non-Fintech Businesses

Embedded

finance is revolutionizing customer experience and business models for

companies outside of the traditional banking space. Here’s how:

1.

Unlock New Revenue Streams: Collect transaction fees, earn interest on embedded

lending, receive revenue shares on insurance sales, and more.

2.

Boost Customer Loyalty: Offering financial services within your app keeps

customers engaged and more likely to return.

3.

Enhance Customer Experience: Frictionless payments, one-click checkouts, and instant

financing lead to higher satisfaction and conversion rates.

4.

Expand Market Reach: Attract customers seeking seamless, all-in-one solutions—no need to

visit a bank.

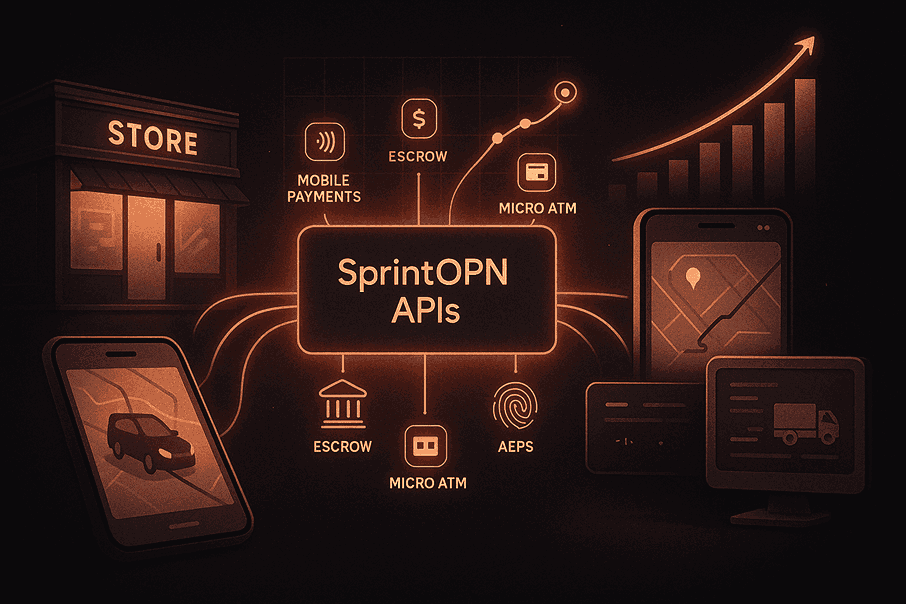

How SprintOPN APIs Power Embedded Finance

With

SprintOPN, non-fintech businesses can plug in a range of financial APIs—fast,

securely, and with minimal coding effort. Key functionalities include:

1.

UPI & Payment APIs: Enable customers to pay digitally or withdraw cash at

the point of sale. Learn more at :- https://www.paysprint.in/services/upi-api-provider.html

2.

Account Creation & KYC APIs: Streamline onboarding with paperless verification.

3.

Insurance APIs: Add

convenient, embedded coverage options at checkout or after-sales.

4.

Investment APIs: Allow users to invest in digital gold, silver, or mutual funds

within your platform.

5.

Cash Management & Payout APIs: Manage vendor or supplier payments—ideal for

marketplaces and franchises.

Real-World Examples & Use Cases

1.

Retail: Integrate

point-of-sale lending, branded debit/credit cards, or loyalty wallets. Embedded

lending and BNPL have shown to increase conversion rates by up to 30% and order

sizes by up to 50%.

2.

E-Commerce: Simplify

customer journeys with instant digital payments, embedded insurance, and reward

wallets.

3.

Travel: Offer

automated currency exchange, prepaid travel cards, and insurance for flights or

bookings.

4.

Logistics: Automate

vendor payments, enable fast driver payouts, and provide insurance for

shipments.

5.

Education & EdTech: Allow parents to buy courses using microloans or

flexible subscription models.

Creating New Revenue Streams

Non-fintech

businesses leveraging SprintOPN APIs can monetize in multiple ways:

1.

Transaction Fees: Earn a percentage on every payment or transaction.

2.

Subscription Models: Charge for premium financial features, such as higher spending

limits or priority support.

3.

Revenue Sharing: Partner with insurers, banks, or lending providers for commission

on products sold.

4.

Interest & Interchange: Generate revenue from loans, cards, or managed

accounts.

5.

Data Insights: With

consent, monetize aggregate financial data to inform business decisions (always

prioritize privacy and compliance).

Best Practices for Successful Integration

To maximize

results with embedded finance:

1.

Start with Customer Needs: Identify which features will most benefit your

audience.

2.

Choose Secure, Scalable APIs: SprintOPN ensures easy compliance and robust security.

3.

Design for Seamless UX: Integrate financial features into your core user

journey—no clunky redirects.

4.

Monitor, Optimize, and Innovate: Use real-time analytics to see what works, improve

continuously, and introduce new services over time.

Conclusion

Embedded

finance is no longer just for banks or fintech startups. With platforms like

SprintOPN, any business—from retail to logistics to education—can unlock new

growth opportunities, drive loyalty, and future-proof their offerings by

integrating financial services directly where their customers need them most.

Begin your

journey by exploring SprintOPN APIs, define your key use cases, and discover

how you can turn your existing digital touchpoints into profit centers—all

while making life simpler and more rewarding for your customers.

Frequently Asked Questions (FAQs)

What is embedded finance?

Embedded

finance is the integration of financial services such as payments, lending,

insurance, and investments within non-financial business platforms, allowing

them to offer these services directly to their customers.

How can non-fintech businesses benefit from SprintOPN APIs?

By

integrating SprintOPN APIs, non-fintech businesses can unlock new revenue

streams, improve customer loyalty, reduce friction in user experiences, and

access more data-driven opportunities.

What kinds of financial services can I embed with SprintOPN APIs?

You can

embed UPI payments, Buy Now Pay Later, lending, KYC/account onboarding,

insurance, investments (like digital gold/silver), and cash management

solutions.

Is the integration process complicated?

SprintOPN

APIs are designed for easy integration, with comprehensive documentation and

support, reducing the technical barriers for businesses.

How do businesses earn revenue through embedded finance?

Businesses

can earn via transaction fees, subscriptions, revenue sharing with financial

service partners, interest/interchange fees, and by providing value-added

financial features to customers.

Are SprintOPN APIs secure and compliant?

Yes,

SprintOPN APIs adhere to regulatory standards and implement robust security

protocols to ensure safe and compliant transactions.

Can my business scale financial services later on?

The platform

is flexible and scalable—start with select APIs and add more as your customer

base or business needs grow.

Where can I find technical resources or integration guides?

Visit https://www.paysprint.in for detailed documentation, API reference guides, and direct support channels.