Common Challenges in Cash Management and How to Overcome Them

Effective

cash management is the foundation of financial health for businesses of all

sizes. In today’s fast-paced economic environment, companies face various

hurdles that can disrupt cash flow, hinder growth, and threaten stability. This

blog reveals the most common cash management challenges and practical solutions

to tackle them—empowering your business to operate with greater confidence and

control.

Table of Contents

1.

Introduction

2.

What

Is Cash Management?

3.

Common

Challenges in Cash Management

4.

Conclusion

5.

Frequently

Asked Questions (FAQs)

Introduction

Managing

cash isn’t just about counting money—it requires constant attention to ensure

funds are available when needed and risks are minimized. Businesses, regardless

of industry, frequently struggle with challenges such as visibility gaps,

inefficient processes, inaccurate forecasting, and rising banking costs.

Addressing these pain points is essential for healthy operations and

sustainable growth.

What Is Cash Management?

Cash

management refers to the collection, handling, monitoring, and optimizing of

cash flows within an organization. It encompasses tracking receipts and

payments, maintaining liquidity, forecasting future needs, and safeguarding

against financial risks. Effective systems and practices in this area allow

businesses to meet obligations, seize new opportunities, and avoid costly

pitfalls. Read more about Cash Management

Common Challenges in Cash Management

Poor Cash Flow Visibility

Businesses

operating with multiple accounts, currencies, or global subsidiaries often lack

a real-time, consolidated view of their cash position. This leads to:

- Missed payment deadlines.

- Suboptimal investment of idle

cash.

- Increased risk of unplanned

shortfalls.

How to Overcome:

Centralize

cash data using integrated management systems and leverage cloud-based

dashboards for real-time insights.

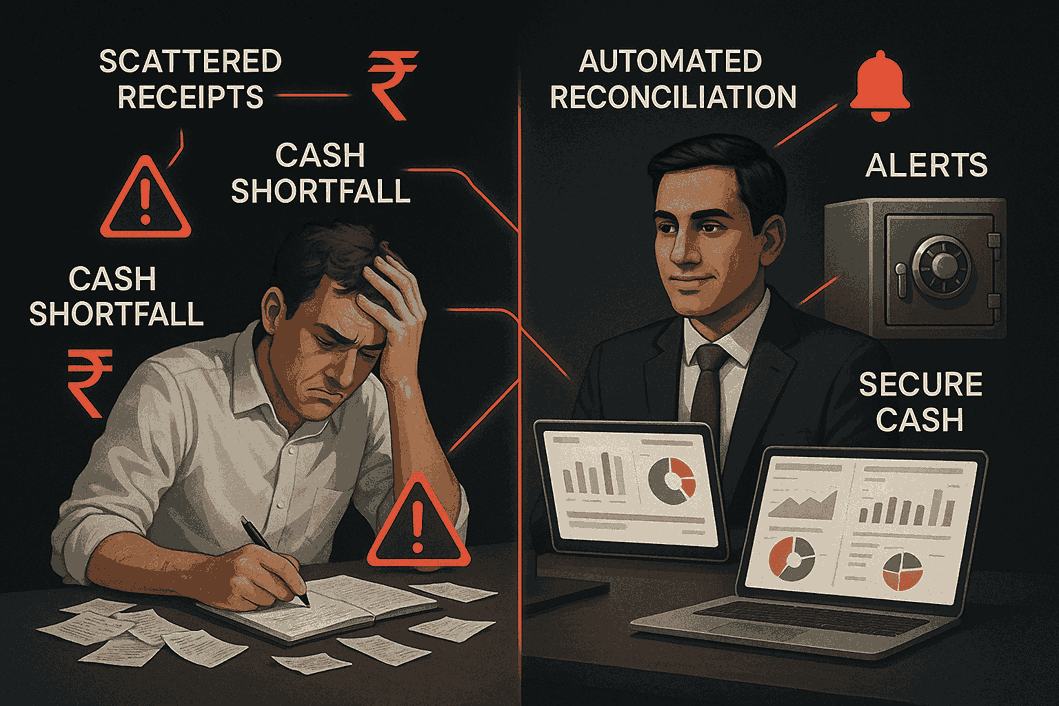

Manual, Error-Prone Processes

Dependence

on spreadsheets and poorly integrated systems increases the risk of human error

and slows financial operations. This can result in:

- Inaccurate balances.

- Delayed transactions.

- Time-consuming reconciliations.

How to Overcome:

Invest in

automated cash management tools that enable seamless data integration and

remove repetitive manual tasks.

Inaccurate Cash Flow Forecasts

Outdated or

incomplete financial data makes cash flow forecasting unreliable, causing

businesses to:

- Overestimate available funds.

- Face unexpected deficits.

- Miss out on investment

opportunities.

How to Overcome:

Update

forecasting models frequently, using the latest data and adjusting for variable

expenses and seasonal trends.

Slow Accounts Receivable Collection

Delayed

customer payments are a common reason for cash imbalances, leading to:

- Working capital shortages.

- Inability to meet financial

commitments.

- Damaged supplier relationships.

How to Overcome:

Send

automated invoice reminders, enforce stricter credit terms, and provide

incentives for early payments.

Excess Inventory or Over-Purchasing

Overstocking

ties up cash, increases storage costs, and raises the risk of obsolescence.

How to Overcome:

Implement

just-in-time purchasing, conduct regular inventory audits, and base buying

decisions on sales analysis.

High Transaction and Banking Costs

Operating

with multiple bank accounts or payment platforms can lead to:

- Excessive fees.

- Reduced liquidity.

- Complex reconciliations.

How to Overcome:

Consolidate

banking relationships and negotiate better transaction rates. Utilize payment

pooling and electronic solutions to minimize costs.

Difficulty Managing Unexpected Expenses

Unexpected

outflows—like equipment breakdowns or regulatory fines—can quickly disrupt cash

cycles.

How to Overcome:

Set up

contingency funds or maintain flexible lines of credit. Proactively assess

risks and budget for emergencies to stay prepared.

Complexity in Multi-Entity or Global Operations

Cross-border

or multi-entity businesses face hurdles like currency conversion, regulatory

differences, and scattered financial data.

How to Overcome:

Adopt

global-ready cash management systems with multi-currency support and unified

protocols across all business units.

Conclusion

By proactively addressing the common hurdles outlined above, businesses position themselves for stability, agility, and growth. Embracing technology, optimizing processes, and maintaining strong financial discipline are key steps to transform cash management from a daily struggle into a strategic asset that propels your business forward. Tools like the CMS API can further streamline your cash management processes, helping you leverage technology for enhanced efficiency and control.

Frequently Asked Questions (FAQs)

What is the core goal of cash management?

The core

goal is to ensure funds are available when needed, while maximizing returns and

minimizing risks such as shortages and fraud.

How does automation benefit cash management?

Automation

reduces manual errors, accelerates workflows, and delivers near-instant cash

position updates—enabling better planning and reduced staff workload.

What are the quickest ways to improve cash collection?

Utilize automated invoicing, establish clear payment terms, and offer early payment discounts to expedite collections.

How often should a business update cash forecasts?

Monthly

updates are standard, but more volatile businesses may require weekly or even

daily reviews.

What’s an effective strategy for managing sudden expenses?

Build a contingency fund based on historical needs, or secure a pre-approved line of credit to address emergencies without derailing operations.