Aadhar Enabled Payment System| SprintOPN

The Aadhaar Enabled Payment System (AEPS) is a payment service that enables a bank user to access their Aadhaar-enabled bank account and carry out standard banking operations, such as checking their balance, withdrawing cash, and sending money through a business correspondent, using their Aadhaar as identification.

What is AEPS?

AEPS is a bank-driven framework that facilitates online

interoperable financial transactions at Points of Sale (PoS) or Micro ATMs

through any banking institution's Business Correspondent (BC) or Bank Mitra,

utilizing Aadhaar authentication.

Table of Content

1.

How Does APES Work?

2.

Features of AEPS

3.

Benefits of AEPS

4.

Types of APES

5.

How to use AEPS

6.

Advantages and Disadvantages of AEPS

7.

Service Offered by AEPS

8.

Objective of AEPS

9.

Future of AEPS

How does AEPS Work?

Step 1- Visit a micro-ATM or banking

correspondent.

Step 2- Enter the number from your

Aadhaar.

Step 3- Select the type of

transaction.

Step 4- Put the sum in.

Step 5- Give your biometric

information (iris scan or fingerprint).

Step 6 - Verify the transaction.

Step 7- Get your money back or get a

confirmation message.

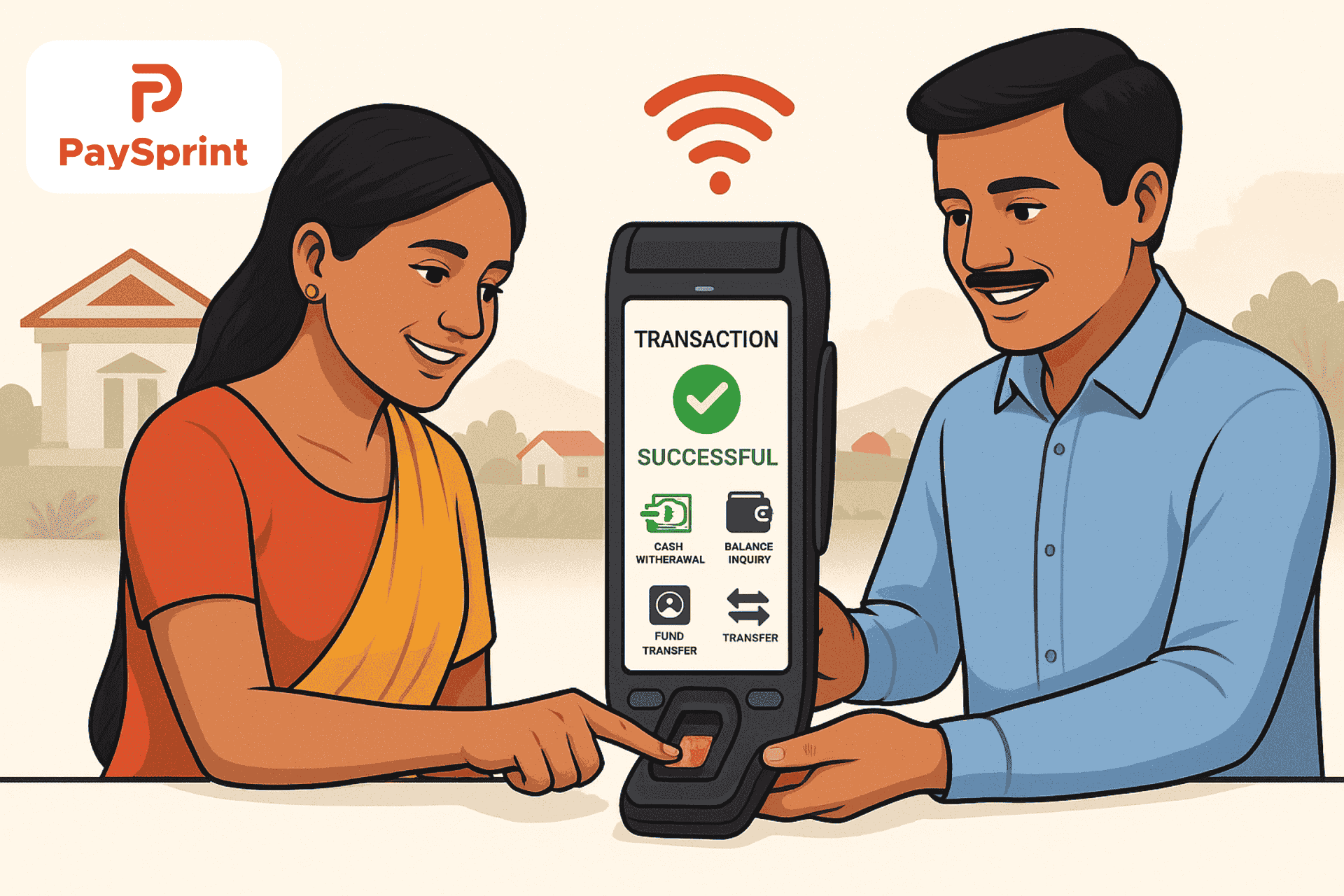

Features of AEPS?

1.

Aadhar-based authentication: Using

the Aadhaar number, AEPS facilitates transactions while ensuring security

through biometric authentication (fingerprint or iris scan).

2.

Interoperability:

Regardless of the bank a user is registered with, AEPS enables them to conduct

transactions across many banks and financial organizations.

3.

Basic Transaction: The

system facilitates the following simple banking transactions:

1. Cash

Withdrawal: Customers have the option to take money out of their

accounts.

2. Balance

Inquiry: Customers can view the amount in their accounts.

3. Mini

Statement: A summary of recent transactions is available

to users.

4. Funds

transfer: Moving funds between bank accounts is known as a fund

transfer.

4.

Offline Transaction: AEPS

can operate with a basic biometric-based system in places with poor internet

connectivity.

5.

Security: The

system offers a high degree of protection for user transactions, lowering the

danger of fraud, because it depends on biometric data (fingerprint or iris).

6.

Financial Inclusion: For

those living in rural or isolated locations who might not have access to

smartphones or traditional banking infrastructure, AEPS offers banking

services.

7.

Fast and Simple Access: AEPS

enables consumers to conduct financial transactions with as little

infrastructure as possible, such as a biometric-scan-capable point-of-sale

(POS) terminal.

8.

Cost-effective: It

provides a reasonably priced banking and financial transaction solution,

particularly in isolated locations where traditional banking options may be

limited.

9.

24/7 Availability: AEPS

offers 24/7 banking services and is accessible anytime.

Benefits of AEPS

For every group in society, the Aadhaar-enabled payment

system (AePS) provides several advantages:

1.

Ease of Use: People

may easily do a variety of financial transactions with AePS because it is made

to be straightforward to use.

2.

Biometric Security: To

guarantee safe and reliable transactions, the system combines the Aadhaar

number with biometric authentication, such as fingerprint or iris scans.

3.

Empowering the Underprivileged: By

facilitating digital financial transactions and giving impoverished communities

access to basic banking services, AePS promotes financial inclusion.

4.

Bank Information Privacy: By

enabling transactions without revealing bank account information, users'

security and privacy are improved.

5.

Convenient Bank Access: By

using Aadhaar authentication, users may quickly access their bank accounts,

negating the need for in-person bank visits.

Types of AEPS

1.

Aadhar Pay: Uses a

customer's Aadhaar number to enable shops to transfer funds to any bank

account.

2.

Balance Enquiry: Enables

customers to use their Aadhaar number to check the balance of their bank

accounts.

3.

Paytm AEPS: This

service, which is a component of the Paytm digital payment platform, enables

users to conduct financial transactions by utilizing their Aadhaar number.

4.

BHIM Aadhar Pay:

Using their Aadhaar number and biometric authentication, customers can pay

participating merchants with this merchant payment service.

How to use AEPS For transaction?

The following describes the steps that must be taken to use

AEPS:

Step 1: Visit a banking correspondent

or micro ATM.

Step 2: Enter the bank name and

Aadhaar number.

Step 3: Select the transaction type

and what kind of transaction you wish to do.

Step 4: Enter the transaction amount

to proceed with the transaction.

Step 5: Use a fingerprint scan to

confirm the transaction.

Step 6: Get your invoice.

The Advantages and Disadvantages of AEPS

|

Features |

Advantages |

Disadvantages |

|

Convenient

to use |

Eliminates

the need for debit cards and PINs by streamlining access through the use of

Aadhaar and fingerprint. |

dependent

on internet and fingerprint scanner technologies, which can be unreliable in

places with inadequate connectivity. |

|

Easy to

Access |

Uses

nearby stores with micro ATMs to make banking easier in places far from

banks. |

AEPS

services are not well known or accessible, especially in places with poorer

internet connections. |

|

Transaction

Type

|

Meets

basic financial needs by offering banking services including deposits and

cash withdrawals. |

Its

usefulness for more complex financial needs, such as loans, is limited

because it does not enable complex banking transactions. |

|

Fraud

and Risk |

AEPS

is normally safe, but if security measures are inadequate, there is a chance

of fraud. |

In

places where security procedures are not rigorously followed, fraud risks may

rise. |

|

Security |

By

guaranteeing that only the account holder may access their account, biometric

authentication can improve security. |

raises

further privacy issues regarding the security and use of biometric data. |

|

Inclusion

Requirement |

Improves

financial inclusion by reaching underserved populations in remote

locations |

Access

is restricted to those who have an Aadhaar number; anyone without this

identity cannot enter. |

Serviced offered by AEPS

The other services offered by the AEPS are as follows:

1.

eKYC

2.

Tokenization

3.

Aadhaar seeding status

4.

Authentication

AePS's goals

1.

Encourage Financial Inclusion: Give

those living in rural and underserved areas access to banking and financial

services.

2.

Encourage the Digital India Project:

Reduce the amount of cash used and streamline digital transactions.

3.

Simplify Transactions: Make

both financial and non-financial transactions simple by offering an

Aadhaar-based payment mechanism.

4.

Promote Cashless Economy: To

support the government's goal of a cashless economy, promote digital payments.

5.

Interoperability Across Banks: Use

Aadhaar verification to facilitate easy transactions across several banks.

Transaction Limit for AEPS

A daily cap of Rs. 50,000 on the total number of

transactions has been imposed by certain banks. The NPCI has set a maximum

withdrawal limit of Rs. 10,000 per AEPS transaction.

What does the AEPS's future hold?

To enhance financial transactions, the Indian government

and the National Payments Corporation of India (NPCI) launched the Aadhaar

Enabled Payment System (AEPS). For this, they intended to employ an Aadhaar

card. This payment method is groundbreaking. This payment method was made

by the creators. In these rural locations, they hope to provide improved

employment opportunities. Access to banking facilities is restricted in

certain regions. As more Indians become aware of the advantages of AEPS, its

future seems quite promising. Several Indian banks have already implemented

AEPS.

Conclusion: AEPS

In India, the Aadhaar Enabled Payment System

(AePS) is a revolutionary digital payment system that has

contributed to the increased accessibility and security of banking services. It

is anticipated to keep developing and be crucial to India's financial future.

FAQs- AEPS

Q1. What is Aeps and how it works?

AEPS is a bank-driven framework that facilitates online

interoperable financial transactions at Points of Sale (PoS) or Micro ATMs

through any banking institution's Business Correspondent (BC) or Bank Mitra,

utilizing Aadhaar authentication for verification.

Q2. Are AEPS and UPI the same?

AEPS and UPI serve different purposes. AEPS operates by

utilizing Aadhaar and biometric authentication for transactions, specifically

targeting rural and underbanked populations.

In contrast, UPI (Unified Payments Interface) facilitates

instantaneous payments through mobile numbers or UPI IDs, emphasizing digital

transactions

Q3. Is AEPS safe to use?

AEPS, or Aadhaar Enabled Payment System, is a secure

payment solution offered by the National Payments Corporation of India (NPCI).

It enables individuals with bank accounts linked to their Aadhaar numbers to

conduct financial transactions effortlessly through Aadhaar-based

authentication.

Q4. What is the limit of AEPS per day?

The daily transaction limit for the Aadhaar Enabled Payment

System (AEPS) is determined by individual banks and the specific nature of the

transaction. The highest permissible cash withdrawal amount through AEPS is Rs

10,000 for each transaction.

Q5. Who Controls AEPS?

The Aadhaar Enabled Payment System (AePS) is a

banking-oriented framework established by the National Payments Corporation of

India (NPCI).

Q6. What is the age limit for AEPS?

As per the guidelines issued by the Reserve Bank of India (RBI), there is no specific age limit for using AEPS.